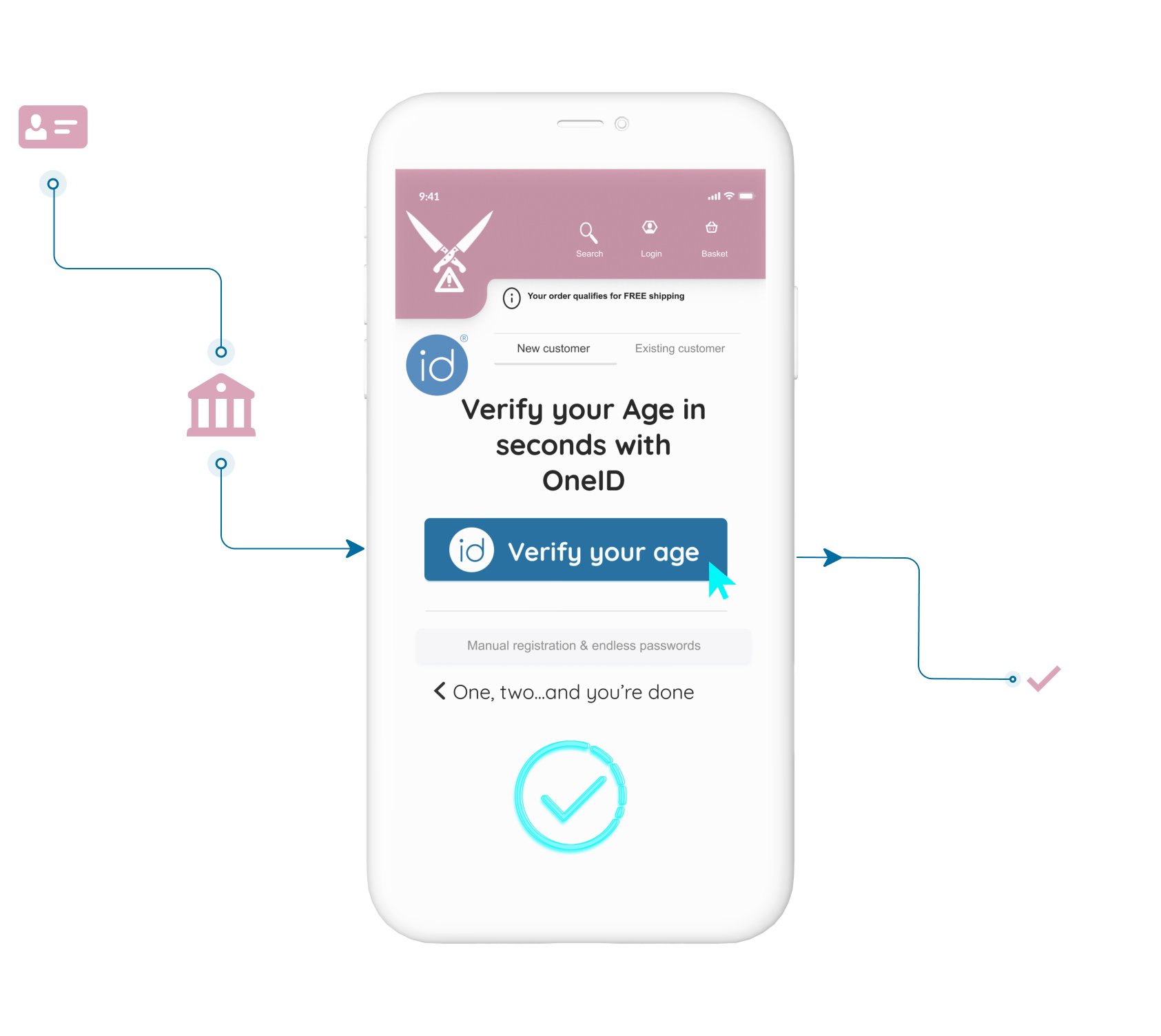

Verify and sign-up your customers in seconds through their bank app and OneID®.

Identity verification and onboarding are real-time and self-serviced, leaving time for your customers to get to the good stuff.

Reduce the risk of fraud by getting to know users via information stored behind bank security, protecting your business.

No document uploads and real-time verification means no more manual identity checks, saving time and money.

Fed up of losing people at account creation? Spending time and money on refunds for incorrect buyer details? Age verification bogging you down?

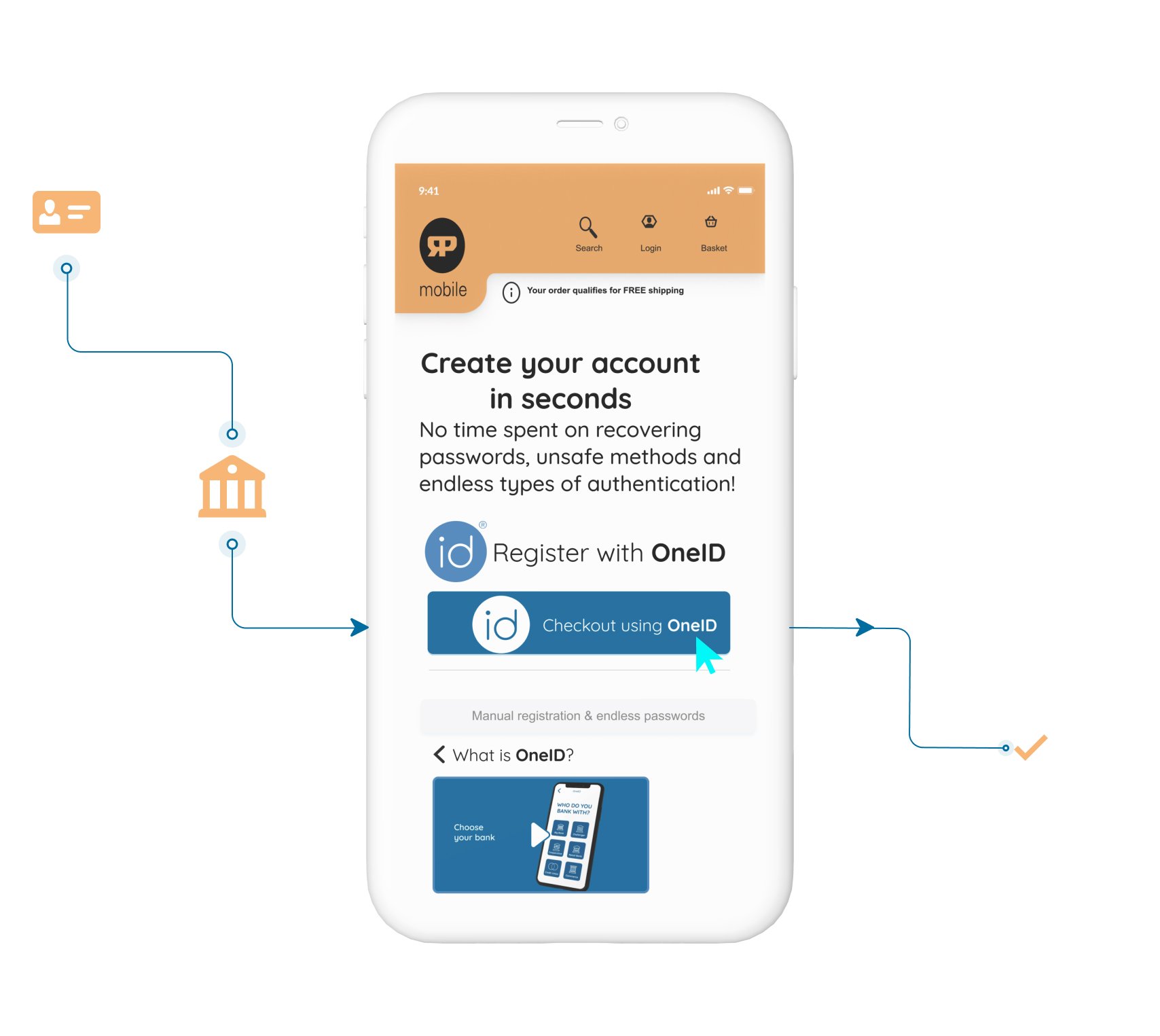

OneID® lets customers prove who they are quickly and securely using their bank app – simplifying sign-up, combating fraud, and reducing abandonment rates.

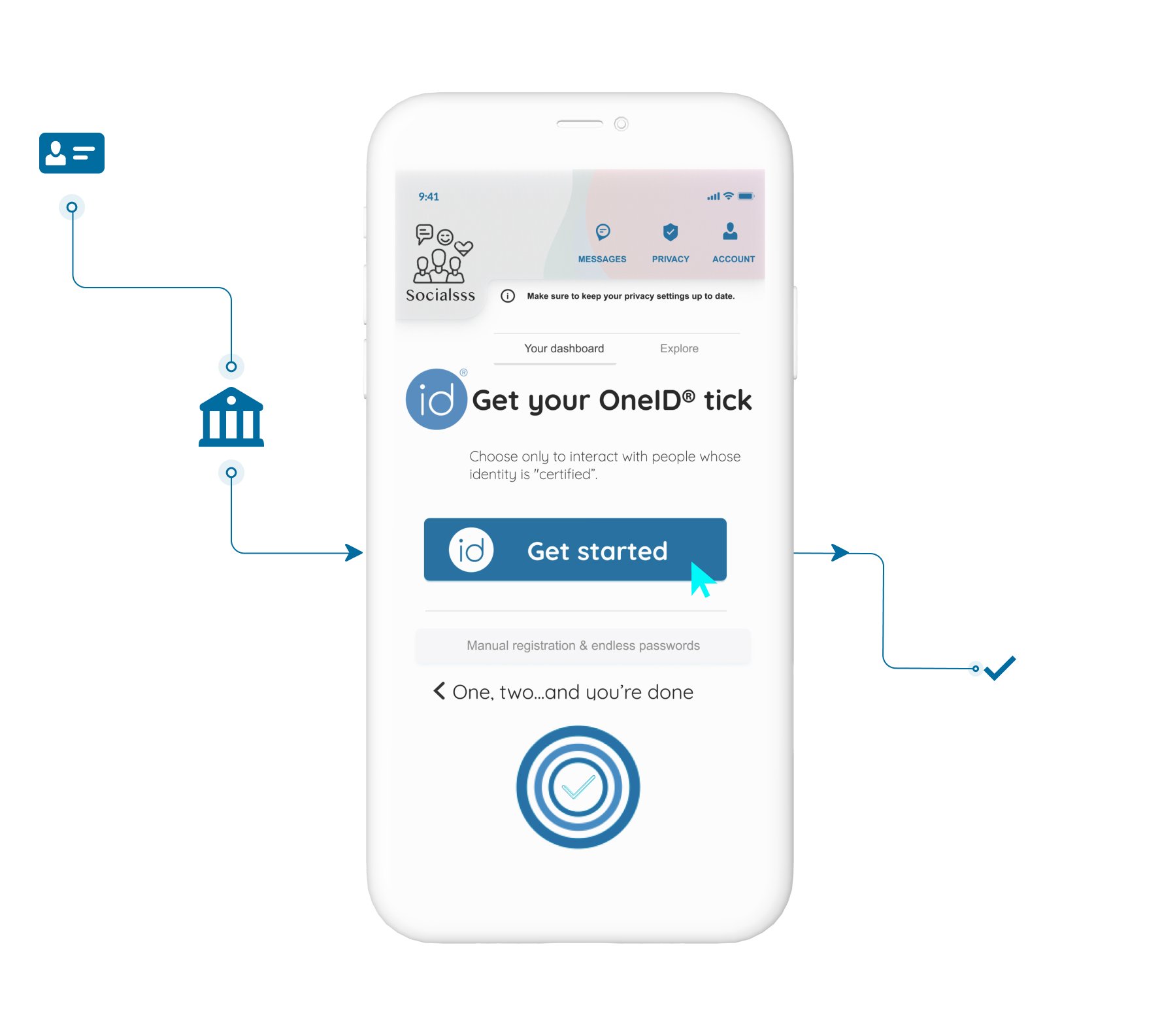

With the digital shift posing challenges on many businesses, not just the telecoms sector, many players are struggling to adapt and ensure customers experience a simple and frictionless online experience.

The unique OneID® solution delivers a simple and frictionless onboarding process, providing you with secure and bank-validated customer identity information – dramatically simplifying customer sign-up, combating fraud, and greatly lowering your onboarding costs.

With online consumer spending rising at unprecedented rates, it seems clear that there will be no retreat from today’s digital-first market for goods, services and entertainment.

OneID® enables a frictionless onboarding journey, providing secure and bank-validated customer identity information – dramatically simplifying customer sign-up, combating fraud, and reducing abandonment rates.

The social and economic shocks of recent months have shaken every business sector, the financial services being no exception.

With abandonment rates exceeding 80% on mobile platforms, an assured digital identity solution can help you tackle these challenges.

Using OneID®, your business can significantly reduce new customer acquisition and verification costs.

In the digital age, identity verification has evolved from cumbersome physical processes based on scanni...

Aaron’s Department, a leading provider of Disclosure & Barring Service (DBS) checks for organisation...

As promised in my last blog recapping our webinar, 'Modernising KYC: Why Innovators are Adopting Digital...

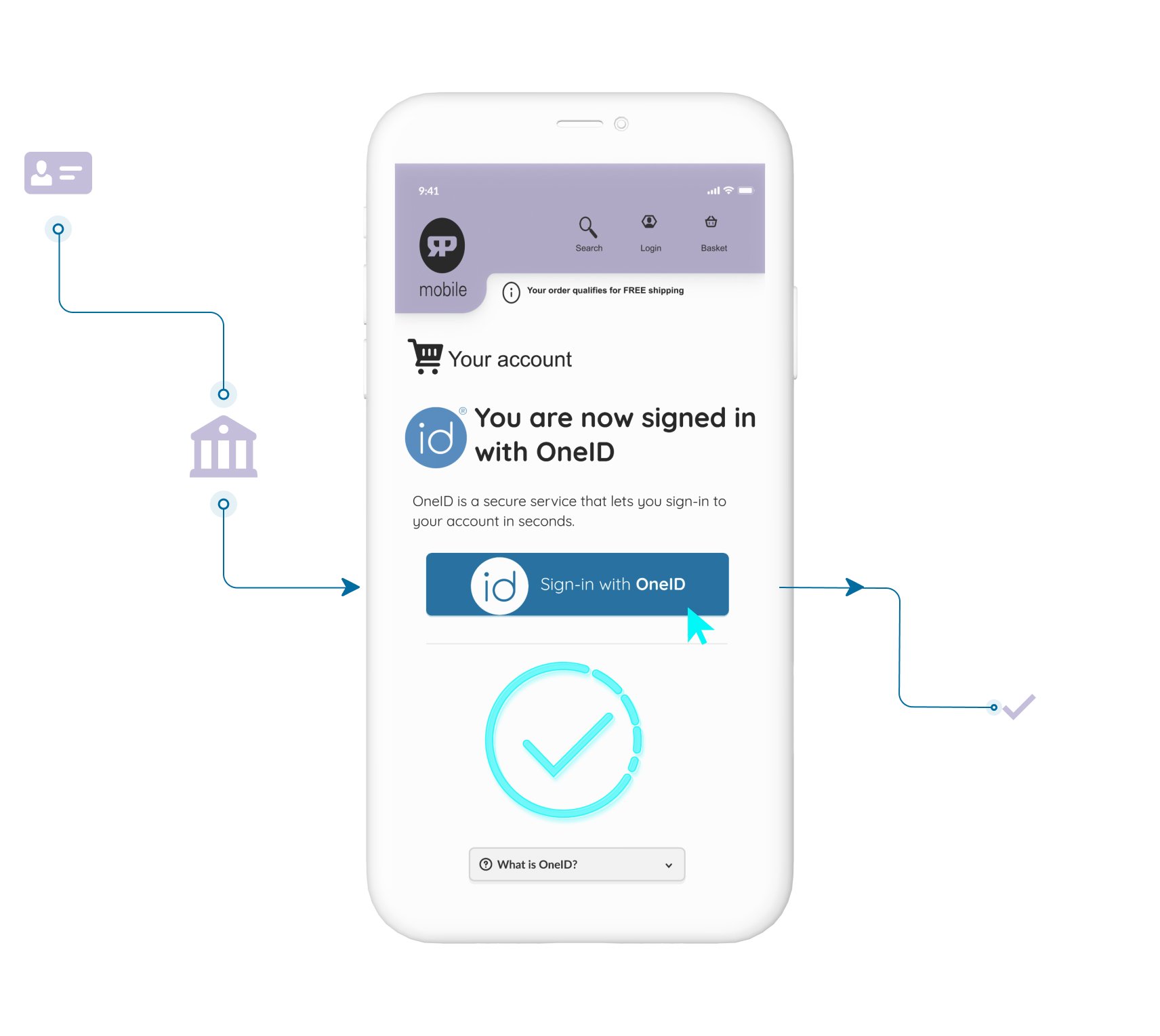

OneID is the online identification service that allows customers to easily make themselves known to organisations by using the authentication mechanism available through the online channel of their own provider. Organisations can receive reliable data from customers in a secure and effective way, using the UK's open banking infrastructure. Providers are able to securely release data with the explicit consent of their Customers through the secure OneID system

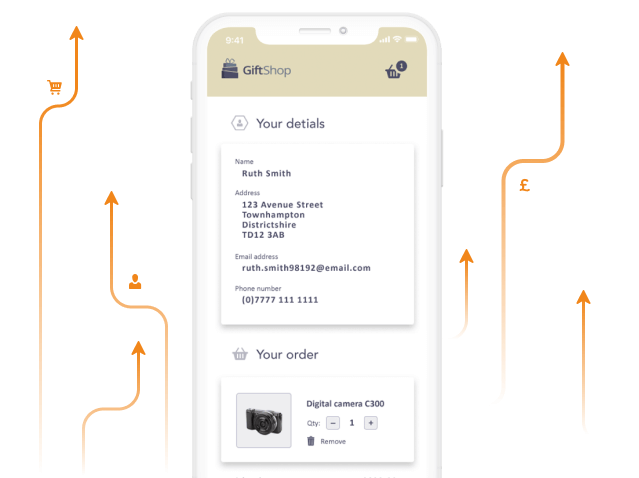

The core function of OneID is to facilitate a new way of onboarding customers onto digital services. It allows customers to securely share the personal data held by the bank with online businesses. This allows the business to create new accounts quicker and more securely. Once a customer has created a new account using OneID they are able to then login in the same way. This eliminates the need to create usernames and passwords.

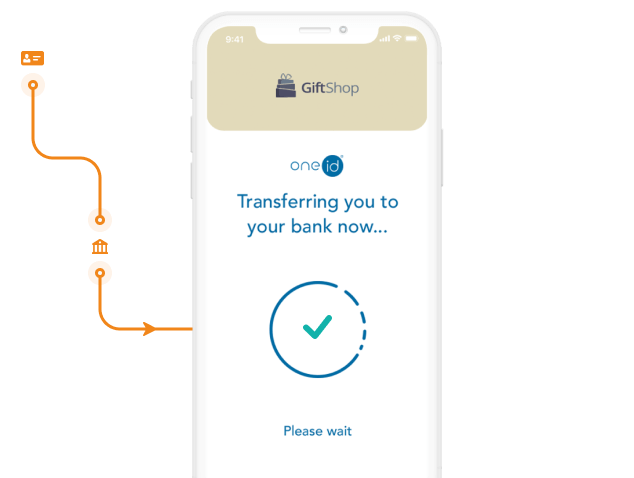

OneID securely transfers specific data between your bank and a registered 3rd party. It captures and stores evidence of the consents you have given to registered 3rd parties and banks to share your data. This prevents fraud, as it requires you to be authenticated by your banking app, whether this be by faced or touch ID.

At Digital Identity Net, we put data privacy at the heart of our products and have designed OneID to ensure that no personal data is ever stored when a consumer uses it. When they agree to share personal data we send it directly from the bank to the business. Digital Identity Net keeps a record of what data was sent but never the actual data itself. So when a consumer agrees to share their name and address we know that’s what was agreed, but we don’t keep a record of the data itself.